December 5, 2013

December 4, 2013

By John Seiler

source

December 4, 2013

By John Seiler

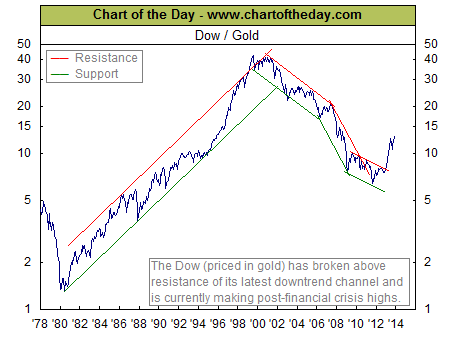

The following chart plots the Dow Jones Industrial Average against gold since 1978. This is important because gold is the only real money. Paper currencies are manipulated by central banks and governments. Remember what happened to the Zimbabwean dollar? How about Confederate dollars or Reichsmarks? All those currencies turned out to be worthless except as collectors’ items.

But if you held an ounce of gold in Alabama in 1864, or in Germany in 1944 or in Zimbabwe in 2010, you still could have bought a great deal of goods and services. And if your descendants still had that ounce today, it would be worth about $1,200.

Notice some things on the chart:

1. On the far left side, we see the tail end of the Nixon-Ford-Carter malaise economy, which struck after Nixon took the dollar off the gold standard in 1971.

2. The huge rise in the DJIA began in 1981, when two things happened. First, Fed Chairman Paul Volcker increased interest rates to kill off inflation. And he pegged gold — unofficially — at $350 an ounce, a price that held, despite fluctuations, until 2001. Second, President Reagan signed his tax cuts into law in 1981.

3. The DJIA stagnated, although it did not decline, in President Bill Clinton’s first term, 1993-96, when he increased taxes and tried but failed to impose Hillarycare, the precursor to Obamacare.

4. The DJIA went parabolic in 1996, when Clinton was running for re-election and signed into law Republican House Speaker Newt Gingrich’s capital gains tax cut. This turbocharged the already revving dot-com boom. Clinton and Gingrich soon produced the first budget surpluses in 30 years. Partisan “gridlock,” decried by most pundits, actually helps the economy.

5. The DJIA crashed after 9/11, not because of the attack, but because of the panicked responses to the attack by Fed Chairman Alan Greenspan, who goosed the currency, leading to the rise in the price of gold eventually to more than $1,000; and by “conservative” President Bush and the “conservative” Republican-run congresses of that era going on a wild spending binges, turning the Clinton-Gingrich surpluses into deficits — since piling up to the massive $17 trillion national debt. Bush also imposed massive new controls on businesses by signing the Sarbanes-Oxley bill, and the currency, banking and other controls in the USA PATRIOT Act.

Bush’s tax cuts, because temporary, didn’t help. And his TARP bailout after the Sept. 2008 panic hurt by grabbing money from Main Street and shifting it to Wall Street.

6. Taking office in 2009, President Obama continued the Bush spending binges, raising the deficits to more than $1 trillion during every year of his first term. He enjoyed a Democratic Congress during his first two years, which doubled down his spending. His spending included his own unstimulating stimulus of more than $700 billion in 2009, then Obamacare. He signed into law the Dodd-Frank hyper-regulation of business.

7. The far right side of the chart shows the DJIA rising against gold, but still way below its peak in the 2000-01 period. The ongoing recovery, such as it is, and the reduction of the deficits, albeit still well above $600 billion, also are occurring under gridlock, as the Republican House has clashed with the Democratic Senate backing the Democratic president.

source

No comments:

Post a Comment